-

18.02.2026EU Updates List of Non-cooperative Jurisdictions

18.02.2026EU Updates List of Non-cooperative Jurisdictions -

09.02.2026Malta Publishes Residence Permit Guidelines for Nomads

09.02.2026Malta Publishes Residence Permit Guidelines for Nomads -

02.02.2026EU Has Blacklisted Russia: What It Means in Practice

02.02.2026EU Has Blacklisted Russia: What It Means in Practice -

28.01.2026Hungary Publishes Guide on the Taxation of Retail Businesses

28.01.2026Hungary Publishes Guide on the Taxation of Retail Businesses -

26.01.2026OECD Publishes Side-by Side Safe Harbor Arrangement Guidance

26.01.2026OECD Publishes Side-by Side Safe Harbor Arrangement Guidance

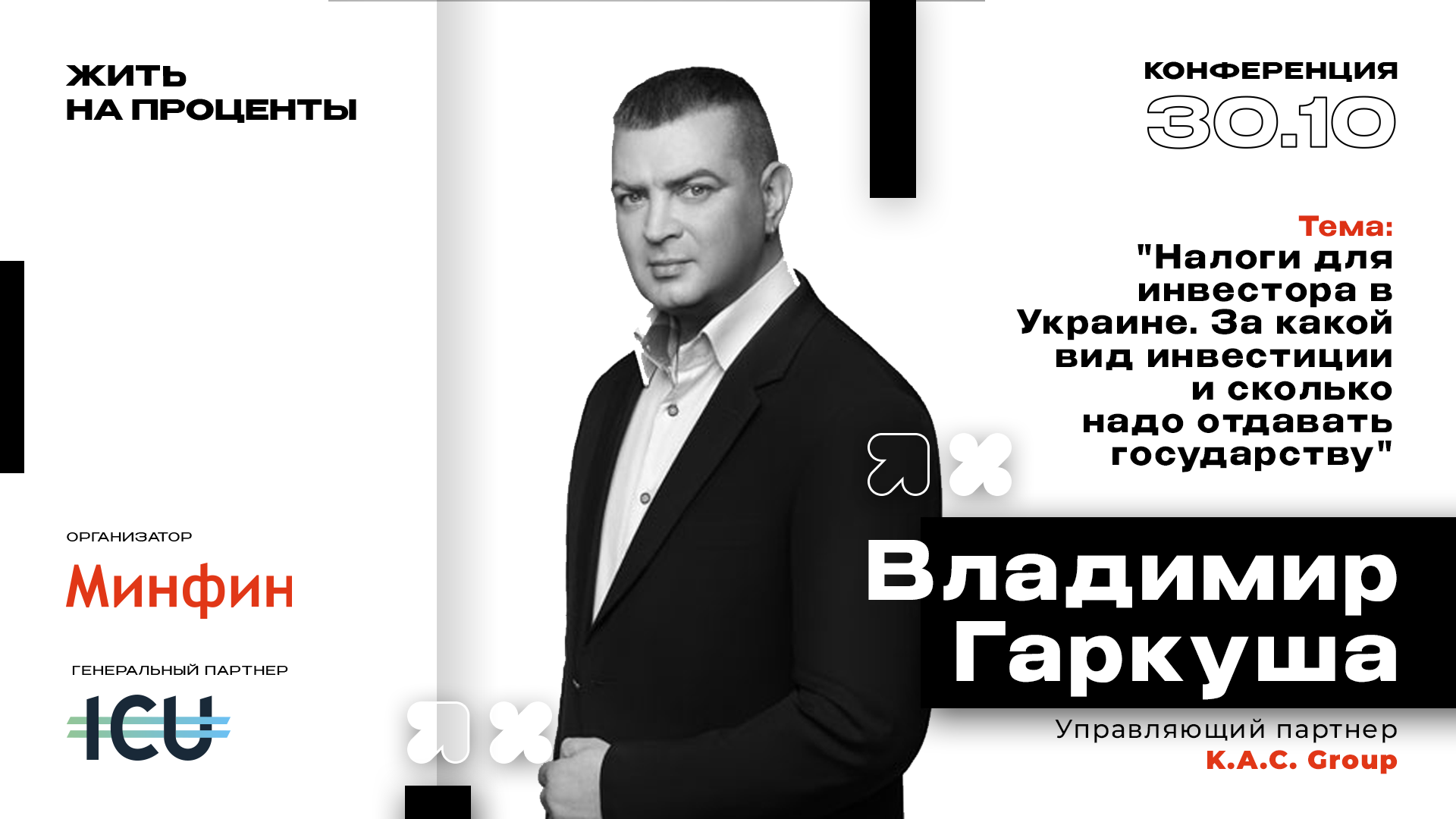

“Living on Interest” Conference

Investing is undeniably an exciting process. However, if you have actually decided to embark on the path of an investor, it is important not to ignore settlements with the state, unless you want the fines to eat up all your earned profits. At the Minfin’s “Living on Interest” conference, which is to take place on October 30 at Pochayna Event Hall, we will analyze all the subtleties and nuances of paying taxes.

Investing is undeniably an exciting process. However, if you have actually decided to embark on the path of an investor, it is important not to ignore settlements with the state, unless you want the fines to eat up all your earned profits. At the Minfin’s “Living on Interest” conference, which is to take place on October 30 at Pochayna Event Hall, we will analyze all the subtleties and nuances of paying taxes.

Our experienced expert practitioner, Managing Partner of K.A.C. GROUP Volodymyr Garkusha will tell you what type of investment and in which amount should be paid to the state.

Volodymyr is an auditor and attorney, a reputable tax and levy consultant, and a securities specialist. He is savvy about modern current methods and changes in tax legislation in Ukraine and abroad.

From the presentation you will learn:

- What the “tax reform” brings and how it will affect each individual investor who is a tax resident of Ukraine.

- How CRS – automatic exchange of information between financial institutions (both in Ukraine and abroad) and tax authorities – is the basis for monitoring investors’ income.

- That no one,including oligarchs,will gain from the tax amnesty.

- How to legalize undeclared available funds when investing in Ukraine and abroad in the context of the laws of a“tax reform”.

- About the conceptual difference between legal legalization of funds under a tax amnesty and financial monitoring by primary financial monetary entities (banks, investment funds, notaries, etc.).

- About all tax aspects of investment by tax residents of Ukraine:

– taxation when investing through a legal entity, individual entrepreneur, physical person;

– taxation when investing in securities in Ukraine and abroad, real estate in Ukraine and abroad, government bonds in joint investment institutions (mutual investment funds, corporate investment funds), in cryptocurrency.

- About the nuances of drawing up a tax return, especially if it is the first one.

The conference offers only practical cases and presentations from the best experts.

- Media (92)

- News (197)

- Events (32)

- Ukrainian Historical Notaphily (4)